.

Get Started with EFTPOS

A Guide to Setting Up EFTPOS for Kiwi Businesses

This guide breaks down how EFTPOS works, what you'll need to get started, and the costs involved.

Get a quote

Get a quote

Understanding EFTPOS payments

EFTPOS payments involve several key players, each with a specific role to play and associated costs

EFTPOS Provider

Supplies the EFTPOS machine, payment software, and ongoing support

Payment Network

Connects your EFTPOS terminal to banks and card issuers to facilitate secure transactions

Bank (Acquirer)

Provides merchant services, including a facility to accept credit cards and settlement of transactions

How EFTPOS payments are processed

Step 1: Your Customer Makes a Payment

Your customer swipes, inserts or taps their payment card or smart device

Step 2: Transaction Is Sent To The Payment Network

-

The EFTPOS terminal sends an encrypted payment request through the payment network to the customer’s bank.

- The transaction is approved if funds are available; otherwise, it’s declined.

Step 3: You Receive the Funds

-

Your acquirer deposits the transaction value into your settlement account

-

Settlement times vary but typically occur overnight, or within 1–2 business days

EFTPOS Providers

EFTPOS providers are responsible for setting up and maintaining your EFTPOS solution.

They assist with:

-

Providing an EFTPOS solution tailored to your business needs - including EFTPOS devices and additional features like POS integrations, surcharging options, and real-time reporting

- Providing technical support for your EFTPOS device

- Ensuring your compliance with payment industry regulations

-

Some providers also develop and maintain their own payment software

Associated costs: Your EFTPOS rental fees depend on the machine type and contract length. Many providers offer a period of free rental to get you started.

Our transparent pricing ensures no hidden fees, and our plug-and-play setup makes installation hassle-free.

Android EFTPOS

Future-ready solutions that grow with your business

We offer a range of advanced Android EFTPOS terminals with flexible lease options, seamless integrations, and round-the-clock support to help you focus on what matters most—running your business.

Payment Networks

The payment network connects your EFTPOS terminal, bank, and the customer’s card issuer to securely process transactions.

- Verifies and authorises payments

- Provides access to transaction data for business insights

Associated costs: A monthly network fee per terminal applies:

- Verifone Network: $15 + GST

- Worldline: $18.90 + GST

Banks (Acquirers)

Your bank plays a crucial role in processing transactions and providing additional payment facilities.

They assist with:

-

Setting up a business bank account

-

Providing a Merchant ID and/or Terminal ID, which is loaded on your EFTPOS terminal, for payment processing

- Facilitating contactless (Paywave) and credit card payments

-

Settling funds into your account, usually overnight

-

Enabling features like MOTO

Associated costs: While EFTPOS debit transactions are often covered under a standard network fee, accepting credit or contactless payments incurs a Merchant Service Fee (MSF), which varies by card type and transaction volume. These fees are charged per transaction and billed monthly. Many businesses offset this cost by applying a surcharge. Your bank may also charge a one-off set-up fee for a new merchant facility.

Banks are not the only providers of acquiring services, but they are the best choice for most businesses. Learn more here

Third-Party Payment Providers

In addition to EFTPOS, debit and credit payments, many businesses accept additional payment methods to cater to customer preferences.

- Credit Card Networks – For example, American Express (Amex) which offers reward programs and premium cardholder benefits, though it typically has higher transaction fees for merchants.

- Buy Now, Pay Later (BNPL) Services – Platforms like Afterpay, Zip and Laybuy allow customers to split payments into instalments.

- Digital Wallets & Mobile Payments – For example, Alipay and WeChat Pay which are popular Chinese apps with payment capabilities.

Associated costs: To accept payments from these providers, businesses need to sign an agreement directly with the provider, sometimes through a facilitator. Each provider/facilitator sets its own fees. For example, Alipay acceptance is facilitated by various providers in New Zealand, but the service itself is provided by Alipay.

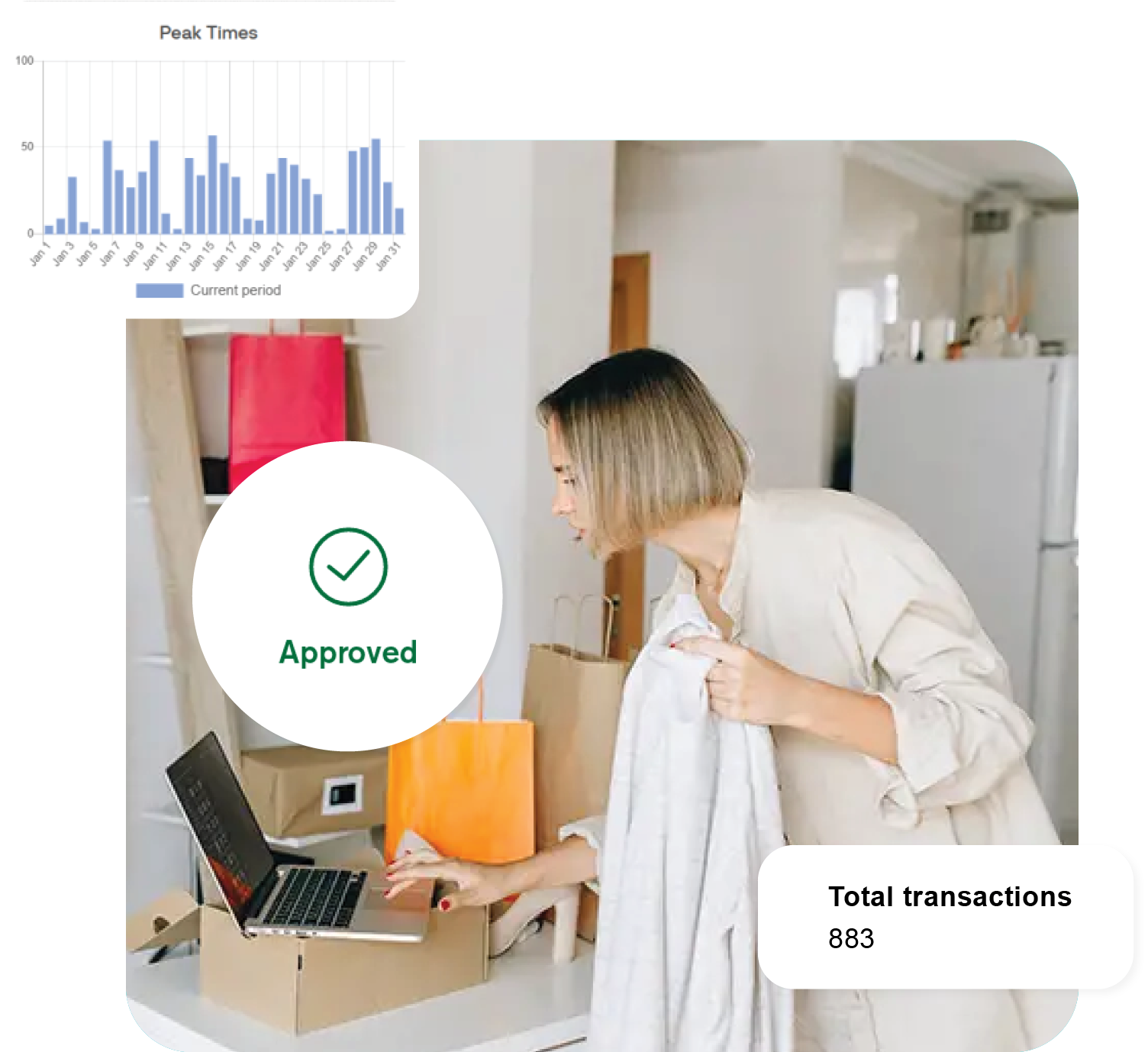

Verifone Central

Manage all your instore and online Verifone transactions on one free, easy-to-use portal. Monitor sales in real-time from any device and create custom reports.

Frequently Asked Questions

What costs can I expect?

You can expect to pay a monthly service fee to lease your terminal which varies depending on the model and leasing term. There is a monthly charge to connect to the Verifone Network of $15.00 + GST per terminal, per month. Your bank may also charge a one-off set-up fee for a new merchant facility. Monthly credit & contactless debit card processing fees charged by your bank may apply.

What payment methods can I accept?

Out-of-the box your terminal can accept locally and internationally issued EFTPOS and debit cards. Your bank will discuss setting up a facility for accepting credit and contactless cards including Visa, Mastercard and Union Pay. Additional payment methods can be added to your terminal, however these are managed by third-party providers.

Where can I see transactions made by my customers?

You can see transaction lists on your terminal. For more in-depth reporting you can use Verifone Central, our free online reporting platform.

How do I integrate my terminal with my POS?

Our payment devices easily integrate with 700+ fixed, mobile and tablet-based point-of-sales to provide a fast and seamless customer experience. Get in touch with us on 0800 EFTPOS and we will guide you through the process.

What support is available?

Our award winning helpdesk is always ready to help you by phone or email 24/7/365 and we offer onsite support nationwide. You can check our online Help Centre for FAQs, how-to guides and user guides. We offer a range of options to ensure continuity of your payment services including overnight swap-outs in metro areas and back-up SIMs. For billing and general support we have a dedicated customer service available business hours.